Corporate taxation

Taxation and public support for businesses have been the object of several studies conducted within the Institute for Public Policy. Corporate taxes interact with a number of tax credits and specific subsidies and are rendered more complex by the imbrication of legal structures built by groups of companies. Understanding the taxation landscape and its implications for firms’ activities thus requires an extensive effort in unpacking complexities.

The finding

Corporate taxation is increasingly central in policy discussions in OECD countries. On the one hand, many governments have introduced taxation reforms designed to reduce the tax burden on firms, with the aim of encouraging growth (for example, tax rate reductions, tax credits for research, and the like).

Understanding the taxation landscape and its implications for firms’ activities requires a significant effort in unpacking complexities.

On the other hand, multinational firms are accused of transferring profits overseas and governments denounce the unfair tax competition measures of some of their partners through the introduction of specific tax reforms. Within the European Union, knowing whether these tax reforms encourage a high-value-added economy, based on innovation and human capital, or the contrary and thereby undermining the European project, is a central concern.

The policy options

Aid to companies in the last two decades has had three main objectives. The first of these has been to stimulate the employment of the least qualified workers while limiting the costs of work: this works mainly through targeted reductions of social contributions, and more recently, via a tax credit (CICE). The second objective aims to reduce the cost to companies of activities deemed to generate positive externalities for other economic actors: this is the case for much of the innovation support (such as the research tax credit and various subsidies). A third major dimension of public action for the private sector has been the introduction of measures intended to stimulate the creation of companies (BPI France programmes).

Evaluation results

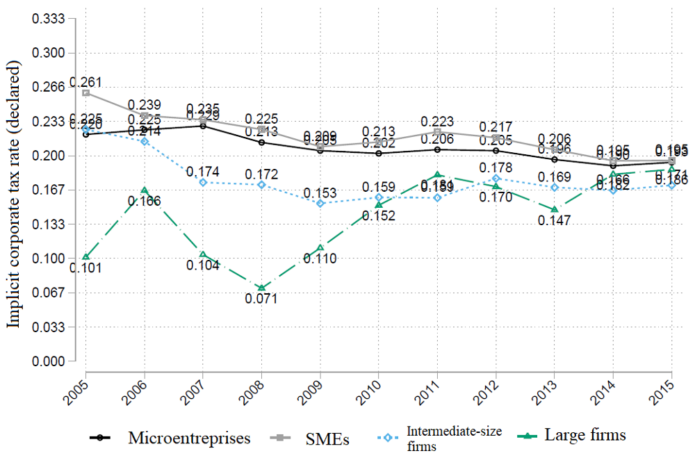

Despite a high statutory rate, the system of company taxation in France has often been described as one that contributes favourably to reducing the tax burden on company profits. Indeed, IPP report n°21 shows that despite a high statutory tax rate (33.33%), the implicit rate is decidedly lower, moving from 19% in 2005 to 21% in 2015.

This average rate hides numerous disparities, especially among companies. Thus, the average implicit rate for large firms was 17.8% as against 23.7% for SMEs in 2015. In the 2005–2015 period, we observe, nevertheless, a partial convergence of the implicit rate for large firms and that for the others. The average implicit rate for large firms increased, from 10% to 17.8%, while the average implicit rate for SMEs decreased slightly, from 27.7% to 23.7%.

Note: Large firms paid an actual average rate of 11% in 2009.

Sources: Data from official company and affiliates’ profit declarations (Bénéfices industriels et commerciaux).

Associated projects

Other projects held by the IPP also investigate corporate taxation :

- the effects to expect from the conversion of the competitiveness and employment tax credit (CICE) into employer contribution reductions (cf. IPP Policy Brief n°36);

- the effects of a change in management, ownership or control on firms’ performances;

- the Impact of the research tax credit on R&D and innovation: evidence from French firms.

Go further – Associated publications

IPP Report n°25 - October 2019

Impact assessment of the taxation of dividendsAuthors: Laurent Bach, Antoine Bozio, Brice Fabre, Arthur Guillouzouic, Claire Leroy, Clément Malgouyres

IPP Report n°22 - March 2019

Impact assessment of the 2008 reform of the research tax creditAuthors: Antoine Bozio, Sophie Cottet, Loriane Py

IPP Report n°21 - March 2019

The heterogeneity of implicit corporate tax rates in France: descriptive findings and explanatory factorsAuthors: Laurent Bach, Antoine Bozio and Clément Malgouyres

IPP Policy brief n°36 - October 2018

What effects to expect from the conversion of the competitiveness and employment tax credit (CICE) into employer contribution reductions?Authors: Antoine Bozio, Sophie Cottet and Clément Malgouyres

IPP Report n°19 - September 2018

Change in corporate governance and firm performanceAuthors: Laurent Bach, Sophie Cottet and Marion Monnet