IPP Report n°24 – June 2019

Towards a universal points-based pension system: what reforms for survivor pensions?How should the pension system be reformed?

The announced pension reform that aims to introduce a universal system using a points scheme is likely to have several effects on the conditions for the payment of retirement pensions, on inequalities and on the long-term stability of the system. Several IPP studies aim to identify the impact of the existing system on retirees and public finances, as well as the effects of potential reforms. The analyses use simulations carried out with the help of microsimulation models developed at IPP.

Findings on the existing system

The French retirement pension system offers payments that are relatively high by international standards, which leads to a high level of contributions. Past reforms have significantly reduced the expected financial imbalances resulting from the ageing of the population (COR, 2016). However, the system still has significant disfunctions. First, the financial equilibrium of the system is uncertain: the system is growth-dependent, requiring growth of at least 1.3% to achieve equilibrium in 2050. Inequalities linked to salary projections are, on the other hand, increased by the pension calculation formula, while support measures could be better targeted: existing family rights do not compensate effectively for career hazards linked to having children, and important disparities are seen in reversionary pension payments, notably because of differences in the calculation models used for such pensions.

In the existing system, inequalities in earnings trajectory are compounded by the retirement pension calculations.

What is at stake in reform of the system?

It is possible, via parametric reform, to correct for the limitations of the current system without changing its whole structure or the calculation formulae; however, the need for clarity in the rules and a sense of equality demand reform that will render the rules of the system clear and applicable to all (IPP Policy Brief n°31).

Results of the simulations

The simulations were conducted using a dynamic micro-simulation model developed at IPP, the PENSIPP model. This model simulates ex ante the effect of potential reforms: several types of points or notional account systems were simulated in order to define the operating rules that would ensure the sustainability of the system and retirement benefit rights for all.

The results show that the system can be operated efficiently through a defined yield scheme in the framework of a structure of notional accounts or points (IPP Policy Brief n°43). This new system ensures long-term stability by offering solid guarantees to the insured. The definition of an “age of reference” at which a person can claim their right to retire, and the redistributive effects of a change to the retirement pension system, also constitute major issues of the reform, of which the work of IPP provides assessments.

Blog posts to debate the current state of the pension reforms

The IPP team participates in debates by posting on the IPP’s blog about pension reform (in French). The impact evaluation published in January 2020 has been analyzed in details, on the link between the point system and the level of the pensions, and on the impact of the 25 best years.

An example: the impact of the “25 best years” rule

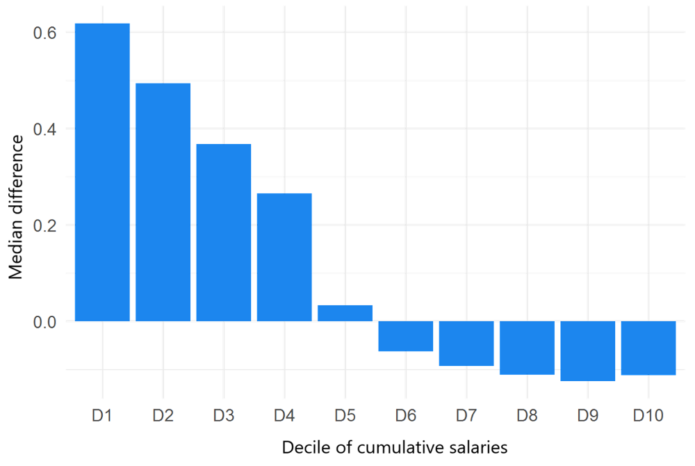

The figure below illustrates the redistributive effects of modifying the calculation rule for pensions that is used in the private sector, from a pension calculated on the basis of the best 25 years of a career (adjusted for inflation) to one based on the whole of a career (adjusted for wage growth). The calculation is made on a fixed budget.

Contrary to popular belief, the 25-best-years rule does not have a protective effect for those on the lowest wages, because it results in greater gains for the most dynamic careers (see the IPP Policy Brief n°44 for more details and the IPP blog for a more instructive explanation).

Figure – Redistributive impact of a career-long calculation rule compared with the existing system (as percentage of the basic pension not including other support measures).

Note: The median difference between a pension calculated according to the existing system and one based on a whole-career points system, wages adjusted according to average wage growth, is 60% for the first decile of the sample, in the absence of any other support measure.

Field: Single pensioners on the basic state pension, born in 1946.

Source: EIR 2008 et 2012 ; EIC 2013 et 2008, Drees ; Pensipp.

Go further – associated publications

IPP Policy Brief n°44 - June 2019

Pensions reform: what redistributive effects are expected?Authors: Antoine Bozio, Chloé Lallemand, Simon Rabaté, Audrey Rain, Maxime Tô

IPP Report n°23 - June 2019

What guidelines for a defined-benefit pension system?Authors: Antoine Bozio, Simon Rabaté, Audrey Rain, Maxime Tô

IPP Policy Brief n°43 - June 2019

How should a points pension system be managed?Authors: Antoine Bozio, Simon Rabaté, Audrey Rain, Maxime Tô

IPP Policy Brief n°42 - June 2019

Is a reference age necessary in a points pension system?Authors: Antoine Bozio, Simon Rabaté, Audrey Rain, Maxime Tô

IPP Policy Brief n°31 - April 2018

Reforming the French pension system : the main challengesAuthors: Antoine Bozio, Simon Rabaté, Audrey Rain and Maxime Tô

IPP Report n°9 - June 2015

Modelling retirement behaviour for French Civil ServantsAuthors: Didier Blanchet, Antoine Bozio, Simon Rabaté

IPP Report n°2 - June 2013

Reforming family-related pension benefitsAuthors: Carole Bonnet, Antoine Bozio, Camille Landais, and Simon Rabaté

IPP Policy Brief n°8 - October 2013

Pension reform: towards an overhaul of family rightsAuthors: Carole Bonnet, Antoine Bozio, Camille Landais, Simon Rabaté and Marianne Tenand

IPP Policy Brief n°3 - February 2013

The French pension system in the long run: balanced or not balanced?Authors: Didier Blanchet